Minutes 6/26/22

EPMFHOA Board Meeting

June 26, 2022

1:30 pm at Jordan’s and Zoom

Attendees: Rick & Claudia Jordan, Susan Novy, Nan Belknap, Nipan Karmacharya, Pete and Linda Hogue, Arleta Bell, Anne Poznic, Becky Velthoen, Jim Myers

Zoom: Pamm Haglund, Max and Yvonne Salfinger, Ronnie LaRue, unknown Owner

Call to Order: 1:32

Secretary Report: Minutes for March and May. Add Anne Posznic to the list of attendees for the March meeting and correct the spelling of Lori Calnon’s name.

Pete moved to approve the March minutes, Arleta 2nd.Passed.

Pete moved to accept the May minutes with the note that Susan’s proposal was tabled until a further meeting. Arleta 2nd. Passed.

Treasurer’s Report: Financials are on the website.

Treasurer’s Report 06/26/22:

FINANCIALS AND FINANCIAL SITUATION

1) The 5/31/22 financials are completed and on the website.

2) Your 2022 finance team is made up of four folks (Becky Velthoen, Linda Hogue, Ronnie LaRue, and

Pete Hogue). While not the desired situation our three key positions/roles (financial secretary,

treasurer, and finance chair) are currently held by two folks (Becky & Pete) which is due to

resignations and retirements during 2021 – with no one else stepping up to improve our resource

situation.

3) Our team met recently and has subsequently gotten involved in two activities in the near term:

a) determining how to invest some of our funds in safe investments (CD’s, MM accounts) given

the fact that the ROI for those types of instruments is improving first step accomplished

b) determining what type of financial review should be done this summer. work in progress but not yet

complete

4) One team member (Pete) is representing the finance team on the MF Outsourcing Team looking at the potential for outsourcing a sub-set of the current volunteer-based responsibilities in several arenas (operational property management, operational financial management, and general/administrative). In addition, another member of the MF Outsourcing Team who is a past finance team member (Anne) is partnering with Pete to ensure effective coverage in the operational financial management arena.

MONTHLY ASSESSMENTS

We have one owner that is in arrears for their June 2022 assessments. We have one other owner that needs to complete payment of a late fee.

SHOW US THE MONEY!

| As of May 31, 2022 | ||

| BOC Checking | $93,782.41 | |

| BOC Operations Savings | 3,757.94 | |

| Fidelity Operations Savings | 6,476.41 | |

| Fidelity Reserve Savings | 84,504.89 | |

| TOTAL | $188,521.65 |

Finance Team has looked into investing the savings into something with more ROI. They looked into a safe CD to put the roofing reserve into a better investment for a 2-year period of time. They want authority to do this without board approval, but let the board know when it has happened and the details.

Rick moved to approve granting the Financial Team the authority to move money into a conservative, safe investment and let the board know where the money is. Nipan 2nd. Passed.

Nipan moved to accept the treasurer’s report, Nan 2nd. Passed.

Planning & Practices Report:

The Town Hall Meeting is next Saturday, July 2, 2022 at the Baptist Church on Mall Rd at 10:30. The next board meeting to determine the budget will be Monday August 1 at 4:00, then the annual meeting will be Saturday August 27 at 11:00 am.

B&G Report:

- The landscaping has begun in earnest with all systems up and running, including the sprinkler system, mowing schedule and trimming begun. Carl has hired a gentleman to do the trimming and he began on Friday, the 24th. The reports I have heard has him doing an excellent job. If anyone has anything special re trimming besides the potentilla bushes, please let me know and I will pass it on to Carl.

- The gutters have been cleaned and I am scheduling it again in the fall if necessary (some years we seem to need it a second time and others not).

- The property will be fertilized and sprayed for weeds this upcoming Monday or Tuesday by TruGreen. Hopefully our afternoon showers will continue.

- Carl has approached me about possible uses for the strip of land on the west end of our property. He said sod would obviously be the most immediately attractive and has the best chance for success but the cost is clearly a factor compared with turning the oil over and planting grass seed. Our ability to water that strip often and thoroughly is a drawback to the success of seeding. Any and all suggestions concerning the use of this strip of property are much appreciated as we do not intend to proceed with any plan without some sort of consensus among home owners.

- Re the perimeter fence: Ronnie and Aaron have inspected them and replaced two posts along Brodie. All remaining posts and railings have been inspected and the fence is weathered but appears to be in sound condition.

- 1421, 1435 decks have been painted with 2 coats of ‘deck paint’. 1434 front porch painted with ‘deck paint’.

- 1421, 1431, 1437 elevated decks need 2 x 10 floor joists placed between existing floor joists to reduce spacing from 24” to 12”. We are searching for a vendor to handle this project.

- We need to complete the siding project with the new siding on Laurie Emmer’s condo and the bottom portion of Lori Calnon’s and Becky Valthoen’s. Carl has agreed to complete the project.

- The replacement deck project is underway at 1454. Tom Couisneau is doing the work and should be done by early to mid-next week depending on the weather.

- The Committee is working on what if any duties we would like to see the proposed Property Management Co would assume for B&G. We would appreciate as much input from home owners as possible in this regard. Given the committee has such a volume of predictable as well as unpredicted issues arise, projecting the dollar cost of this service is a challenge. Basically, the issue comes down to…how much are we willing to pay for the convenience of outsourcing the responsibilities and duties of B&G.

- The snow removal contract. I am in the early phase of talking with Carl regarding adding that service to his present landscaping contract. The advantage is he charges by time…meaning only driveways that are occupied will be shoveled and when we need drift plowing, it will be done to those in need not simply all occupied units. We are hoping the savings will be substantial (and the snow and wind spirits will cooperate).

- The Committee would like to thank Pamm for heading up the Proposed Property Management Committee this Spring and Summer will all the work involved. She has done an excellent job for all the HOA and B&G as well.

Pete moved to accept the B&G Report, Nipan 2nd. Passed.

Insurance Committee Report:

Rick provided the email Q&A response from Danielle at American Family Insurance

Our questions –

Insurance premiums:

– the estimated cost per square foot to reconstruct our condos was increased this year to $250 (from $149 I think).

Correct – 2021/2022 was $148.25sf. 2022/2023 is $250sf

– Do you expect the estimated cost to reconstruct to be increased again next year, especially since we’re reading that the Marshall fire rebuild estimates are coming in much higher than that?

We are seeing a steady inflationary increase to buildings based off of the inflation protection built within the policy. I don’t expect us to implement a manual increase within the next year. The thought of having $250 a sf on the outside and having unit owners carry $100 a sf on their interior policies covers the entire building at $350 a sf which is right in the middle of the Marshall fire rebuild estimates.

- We budget in summer for the following calendar year. Can you help us estimate any increases for calendar year 2023?

We have had a 20% base rate increase due to the fire exposure of the area. You can also expect the implementation of a 10% wind/hail deductible. This will offset some of the base rate change but if you budget 20% you should be safe.

– what options should we consider, that could decrease our premiums?

– higher deductibles?

You are currently carrying a $1000 deductible. Increasing this to $5000 will definitely give some premium relief.

– is our full replacement coverage reasonable?

It’s as reasonable as we can get without blowing the barn doors off. I have never been a proponent of knee jerk replacement reactions due to elevated retail pricing. We also have guaranteed replacement cost coverage on the policy meaning that if we are found to be underinsured during a claim event AMFAM guarantees we will rebuild it regardless of the cost. You must be insured at $250sf in order to carry this endorsement. Which you are.

- how is that different from “extended replacement cost”?

The term replacement cost is just a description of what our calculations say we can replace your buildings for. Extended replacement cost is the presence of some sort of extension offered in the event of a total loss (to cover unseen inflationary costs). For instance, if you have 20% extended replacement cost coverage that means that the company will offer an additional 20% of coverage beyond your listed value in the event of a total loss. Guaranteed replacement cost means that the company will pay whatever price it takes to replace the building regardless of the limit listed on the policy.

- What other options could be considered?

The Condo Enhancement Endorsement (which you have on the policy currently) offers a variety of needed coverages including ordinance & law (code upgrades), guaranteed replacement, and back up of sewer. These are some of the most needed coverages at this time and they are present on your current policy.

Property questions:

– we’ve been told that our landscaping, especially the well-watered grass is pretty fire resistant. Although now fires are a threat year-round it seems. At the Board meeting we discussed the efforts the Colorado Legislature is considering to incentivize less water landscaping than bluegrass.

- Does AmFam have any position or thoughts on how a change like this may affect fire susceptibility (and insurers rates)?

This has not been discussed at this time but in the end fire mitigation should be looked at as a way to keep your insurance rather than a discount option. Other than building sprinklers there is no avenue currently for reduced insurance rates based off of landscaping and other mitigation efforts.

- Are there options for less grass that you prefer or recommend?

The amount of grass does not affect your premiums or your ability to get insurance overall. Hence, I have no recommendation on this action.

Coverage questions:

– Question about shared coverage between each owner’s insurance and HOA’s insurance.

- If a unit has a kitchen fire which damages the interior and drywall, is the HOA’s coverage invoked for any portion of the damage or is it all on the owner’s personal policy?

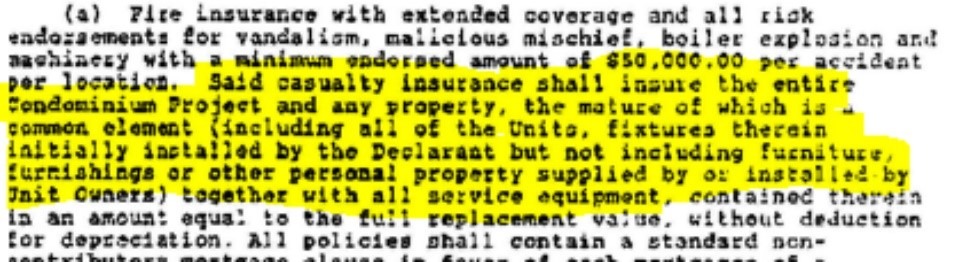

All coverage offered by our policy is set up via your insurance section of the HOA declaration. Unless you have updated these recently, your insurance section is ALL ENCOMPASSING. Meaning we will cover the entire exterior and interior of the building when presented with an insurance loss. Here is a snapshot of the insurance section of the HOA declaration I have on file with the coverage language highlighted.

– Do we have any coverage for possessions inside the condo?

All possessions are the responsibility of the unit owner and their personal policy

– Which, if any, of the appliances are covered under our policy?

Appliances that are permanently attached and generally sold with the condo will be covered under the HOA policy (stove, dishwasher, built in microwave, fridge). Any freestanding appliance (freezers, microwaves, secondary refrigerator) are the unit owners’ responsibility

– Do we have any coverage for additional living expenses, and if so, how much?

Additional living expense is a coverage found in personal unit owners’ policies. The HOA is not responsible for additional living expenses.

– What are our personal liability protection limits?

HOA liability limits are $2,000,000 per occurrence / $4,000,000 aggregate. Again, all personal exposures and personal liability (including personal unit sidewalks, interior unit exposure) falls underneath the personal unit owner’s policy.

– Does American Family re-estimate costs to rebuild each year?

All policies go thru an inflation review every year automatically – but full replacement is generally calculated once every three years or so. We just went thru this mandatory recalculation 2021/2022.

– What recommendations do you have for our HOA based upon your knowledge of our properties and our existing coverages?

The only suggestion I would make is to look at restating your HOA declaration insurance section. All-encompassing language such as this opens the door to many small claims and nickel and diming your insurance coverage. It is in the HOA’s best interest to make the unit owner responsible for their unit interior damage in the event of loss.

Finance Director requested items:

– Am I correct that it is up to our association board to determine how to “cover” the insurance premium costs through/as one part of our Operating Fund assessments revenue line item [within the insurance related parameters & constraints found in our Declarations]?

Unfortunately, I am not an HOA legal advisor. I do not know the duties of your board as designed in your declarations. As far as insurance policy premiums, it is the responsibility of the insured to make appropriate payment. The named insured is the HOA and the board is the representative of the HOA and acts on its behalf.

– Am I correct that once our insurance premium is finalized/set for the year (which we pay in monthly installments) any MF HOA submitted claim will be paid to the HOA (minus our deductible) based on the estimated repair cost done by your insurance appraiser (whether in house or contracted).

Correct – All insurance claims payments will be made in the name of the insured, Estes Park Mountain Fairways. It is then the responsibility of the HOA to disperse funds to the appropriate contractors.

- Further, that our received monies in case of a major/catastrophic event/loss (estimated repair cost minus our deductible) will take place even if the damage amount exceeds the full replacement value figures that are the basis for the premium (in other words, your company as both our insurance agent and underwriter) bears the risk should we be underinsured in actuality for the major/catastrophic event should our combined work to ensure that doesn’t happen be inaccurate planning?

You have selected to carry the guaranteed replacement cost endorsement. If the repair/rebuild cost exceeds the listed values this endorsement will activate a retroactive change to the current years policy, increasing the listed values to the appropriate time of loss estimates hence giving you exactly 100% replacement value. The pro-rated premium for the difference in coverage will be billed out to the insured and become an insurance liability. Meaning that if we were found to be $1,000,000 underinsured, the policy would retroactively increase the overall coverage by $1,000,000 to this year’s policy term and bill out the premium resulting from adding this $1,000,000 in coverage. It is a safety net feature that is imperative during a time such as this as it is impossible to know the exact replacement values on any given day. We place the policies to the closest replacement values available at the time so in the event of a loss we do not have a large discrepancy but this endorsement gives you the security knowing that if the policy is dramatically off you will have access to the funds to rebuild.

1

Property Management Committee Report:

MFHOA OUTSOURCING TEAM – 6/26/22 REPORT TO BOARD

We envision that this same information (in this form or a different form) would be what is used at the Town Hall meeting

The information under the headings below provides an overview of our team, our assignment/expectation from the board, and the current status of our work.

Team Membership & Purpose

1) The team, with Pamm Haglund as team leader, is composed of:

a) members of the board with key committee/team roles in addition: Pamm Haglund, Ronnie LaRue, Nan Belknap (all B&G) as well as Pete Hogue (finance) and Susan Novy (PP&T – insurance)

b) owners: Yvonne Salinger, Anne Poznic, Lori Calnon.

2) Our team objective is to determine a reasonable set of current volunteer-handled responsibilities & activities for potential outsourcing and locate/research local property management companies that could & would contract with us to handle them. The ultimate result is creating a recommendation for consideration by the Board.

Our Recent Activities

1) Our original approach was to interact with a single property management company, one used satisfactorily by our neighbors to our West, in order to accomplish the objective.

2) We provided a scope of work grouped in three arenas, with both operational and administrative components in each: property asset (facilities) management related, financial management related, and general. That scope is being further refined in both our key first two arenas shown above. We obtained basic information about the organization which is Association Management – Estes Valley [AMEV].

3) We did a walk-through of our Mountain Fairways grounds with a representative from AMEV named Lisa Rosenhagen on Monday, 6/6/22. We have received a “bid” from AMEV and are clarifying our understanding of that material.

4) We will be meeting/have met on Friday, 6/24/22, to determine our next steps. We will provide team representation & information (potentially this document) at the Saturday, 7/2/22, MF Town Hall Meeting.

Our revised Approach & Key Questions Being Addressed

1) Based on the importance of this work, we have revised our approach to interact with several other property management companies in order to ensure the best solution for our association.

2) The three key questions we will answer prior to making our recommendation to the board are:

a) are we comfortable with the premise that selected outsourcing is a strategic action do be done in the best long-term interest of the association?

b) is the timing (as premised below) right for this action?

c) is the to-be-selected property management company the right solution for our association – both in the short term and longer term?

3) Our two key premises related to timing and cost include:

a) the agreement (contract) would be for the year 2023

b) the 2023 Budget Worksheet (initial version done in July/August of this year) would include provision for the expense related to the selected property management company; this budgeted monies would include both the one-time costs and the monthly costs. Our current very preliminary estimate of cost is the range of $600 to $1,000 per month.

4) At the current time there are many topics being addressed by the team. On some of these topics there is a reasonable degree of agreement among the team members. On other topics there are significant differences of opinion among the team members. There is one thing that has consensus agreement by all team members, which is there is a lot of work yet to be done by this team before we will share final information with, and bring a recommendation to, the board.

Town Hall Prep: Pete and Rick are going to run the show with all the information collected above. Danielle from American Family Insurance will be there to present and answer questions.

Agenda:

AGENDA – MF TOWN HALL MEETING

[Saturday, 7/2/22, 10:30 AM, EP Baptist Church (2200 Mall Road)

I. Welcome & Overall Plan for The Town Hall Meeting

II. FIRST KEY TOPIC – MF PROPERTY INSURANCE & ASSOCIATED COSTS

1) Introduction of speakers & approach for this agenda item Pete Hogue

– what insurance is in scope for today and what is not?

– meeting objective: getting MF owners current on insurance matters that impact them

– Pete Hogue (Board member & insurance team member & finance team chair) and Rick Jordan (Board member &

insurance team lead) will facilitate this topic on the Board’s behalf

– Danielle Arnold will represent American Family Insurance – our insurance agency

2) What has changed in the insurance industry recently and how has that impacted HOA insurance coverage and premiums

in general? Danielle Arnold

3) What impact has there been on the MF owners as a result – in particular the impact in 2022 and the coming impact in

2023? Rick Jordan & Pete Hogue [MIA]

– major increase in MF property insurance premiums

– major change coming in how deductibles are handled

– how the impact of increased premiums has been mitigated in the short term for MF owners

4) What knowledge/understanding does each MF owner need to take away from this meeting? Pete Hogue

6) General question & answer time presenters, MF insurance function team

III. SECOND KEY TOPIC – MF OUTSOURCING STRATEGY & TEAM (including current status & associated future costs)

1) Introduction of speakers & approach for this agenda item Pete Hogue

– who makes up the Outsourcing Research Team [ORT] and what is in their scope and what is not?

– meeting objective: getting MF owners current on the outsourcing of selected volunteer-based responsibilities &

activities that impact them

– Pamm Haglund (Board member & ORT team leader) and Pete Hogue (Board member & ORT team member & finance

team chair) will facilitate this topic on the Board’s behalf

2) Information on strategic direction, status report from the ORT, and potential cost impact for 2023. Pamm Haglund &

Pete Hogue [MIA]

3) General question & answer time presenters, ORT team

IV. Adjournment

*****************************************************************

MIA = material in advance of the meeting for review prior to the meeting

HAND = handout at the meeting

Questions for each of the two specific agenda topics will be answered either during individual items related to the topic or at the end of that specific agenda topic [at the discretion and direction of the speaker(s) covering each topic]

Next Meetings:

Town Hall: July 2, 2020 at 10:30 at Baptist Church off Mall Rd.

Board Meeting: August 1,2020 at 4:00 at Rick’s

Annual Meeting: August 27, 2020 at 11:00 at the Baptist Church off Mall Rd (to be confirmed)

Adjourn: 3:06

Posted in Minutes 2022 by Susan with no comments yet.

Leave a Reply